2024 Wrapped: The Year That Shaped Canadian Insurance

As the calendar turns to 2025, we reflect on a transformative year for the Canadian insurance industry. Inspired by the concept of Spotify Wrapped, this retrospective captures the trends, challenges, and innovations that defined 2024. Here’s what made the list:

1. A Softer Market Emerged

2024 marked a pivotal moment as reinsurance rates softened, with declines of 5-15% for loss-free accounts. This shift signaled increased competition, reshaping commercial insurance dynamics and pushing insurers to find new ways to differentiate themselves.

Source: Reuters, December 2024

2. Broker M&A Declined

The broker M&A landscape saw a 10% drop in deal activity compared to 2023, reflecting market uncertainties and shifting priorities. Despite this slowdown, strategic opportunities remained for firms navigating this evolving space.

Source: Business Insurance, October 2024

3. Catastrophes in Focus

Climate risks dominated the headlines as Canadian wildfires contributed over $880 million in insured losses, while total natural catastrophe losses neared $9 billion. This underscores the growing need for innovative risk solutions as insurers grapple with the financial toll of extreme weather events.

Source: Canadian Underwriter, November 2024

4. Cyber Insurance Soared

As ransomware attacks and data breaches escalated, demand for cyber insurance surged. This growth reflected a growing awareness among businesses about protecting their digital assets in an increasingly risky environment.

Source: IBC, July 2024

5. Artificial Intelligence Transformed Insurance

AI became a cornerstone for innovation in 2024, revolutionizing underwriting, customer engagement, and operational efficiency. Insurers increasingly leveraged AI-driven tools to enhance decision-making and personalize customer experiences.

Source: Insurance Business Canada Magazine, February 2024

6. IFRS 17 Took Over

In 2024, IFRS 17 reshaped financial reporting in Canada’s insurance industry, prioritizing transparency and standardized profit calculations.

Source: Insurance Business Canada Magazine, August 2024

7. MGAs Expanded Market Share

Managing General Agents (MGAs) strengthened their foothold in the Canadian market, with an increased focus on commercial lines. Their specialized solutions and nimble approaches continue to reshape distribution models and meet niche customer needs.

Source: Canadian Underwriter, January 2024

8. InsurTech Disruptions

In 2024, MGAs in Canada increased their share of the commercial insurance market from 20% to nearly 40%, reflecting a significant shift towards specialized underwriting solutions.

Source: Bobsguide, June 2024

9. Regulators Responded

Regulators called out insurers over fairness gaps, citing a 30% rise in P&C complaints and delays that left customers frustrated.

Source: Insurance Business, November 2024

10. Back to the Office

Hybrid work models took center stage as insurers redefined workplace policies in 2024. Employees adapted to a balance between in-person collaboration and remote flexibility, with insurers focusing on maintaining productivity and employee satisfaction.

Source: Canadian HR Reporter, October 2024

2025: A Dynamic Path Forward

The Canadian commercial insurance market is expected to grow 4.5% annually, driven by climate risk solutions, tech adoption, and evolving customer needs.

Source: GlobalData, December 2024

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

Latest Data Insights from OSFI Reporting

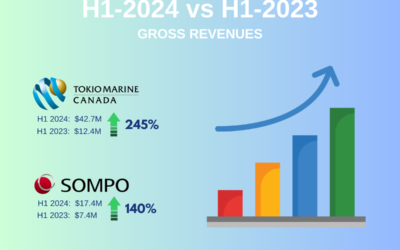

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property & Casualty (P&C) insurance sector. Leading the...

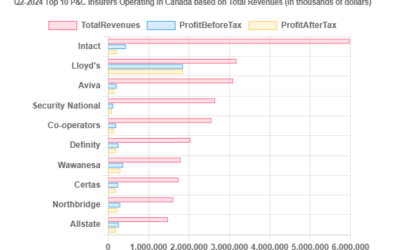

Q2 2024 Canadian P&C Results and Insights

The Q2 2024 results, based on OSFI-reported data, reflect steady financial performance across Canada’s Property & Casualty (P&C) insurance...

Canada’s Top 10 P&C Insurers: Q2 2024 Profit Leaders

The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty (P&C) insurance sector, with total net profits after...

Canada’s Top 10 P&C Insurers: Q2 2024 Revenue Leaders

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial revenue growth, reaching a year-to-date total of...

Latest Articles

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.