In the insurance industry, affinity programs have become a powerful way for organizations to deliver added value to their members. These programs offer customized insurance solutions to specific groups, like alumni associations, professional organizations, or trade unions, often at exclusive rates. By leveraging the collective needs of a group, affinity programs provide benefits that are tailored, cost-effective, and impactful.

In this guide, we’ll break down what affinity programs are, explore their benefits, identify the key players involved, and examine some of the challenges these programs face.

What Exactly is an Affinity Program?

An affinity program is a specialized insurance offering designed for a defined group of individuals or businesses with common interests or needs. These groups could range from professional associations and alumni networks to trade unions and member-based organizations.

By pooling similar needs, affinity programs enable organizations to negotiate lower rates, customize coverage, and even offer extra services that individual policies don’t provide. This approach builds loyalty and strengthens bonds between members and their organization.

The Benefits of Affinity Programs

Affinity programs provide unique advantages for both members and the supporting organizations:

-

- Cost Savings: Members can access lower premiums, thanks to the group’s buying power.

- Tailored Coverage: Coverage is customized to meet the group’s unique risks, ensuring relevant protection.

- Enhanced Risk Management: Many programs integrate risk management strategies that help reduce claim frequency and severity, benefiting members and insurers alike.

- Added Value: Beyond financial savings, affinity programs may include perks like wellness resources, legal support, or specialized tools that increase the overall value for members.

These benefits make affinity programs an attractive choice for organizations looking to enhance services and strengthen member loyalty.

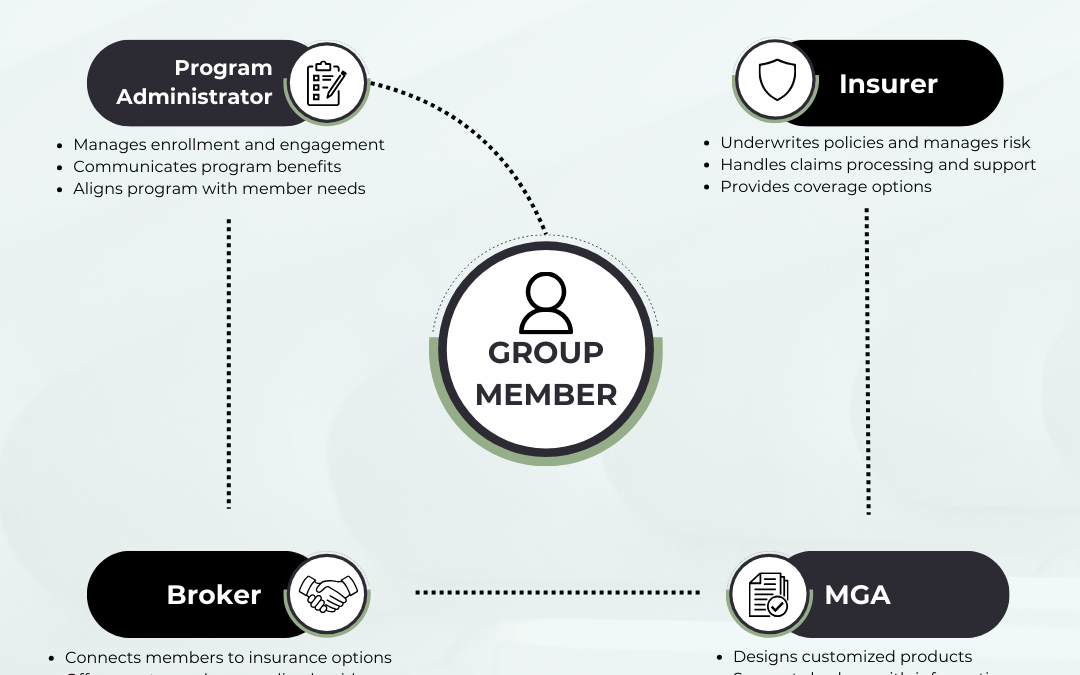

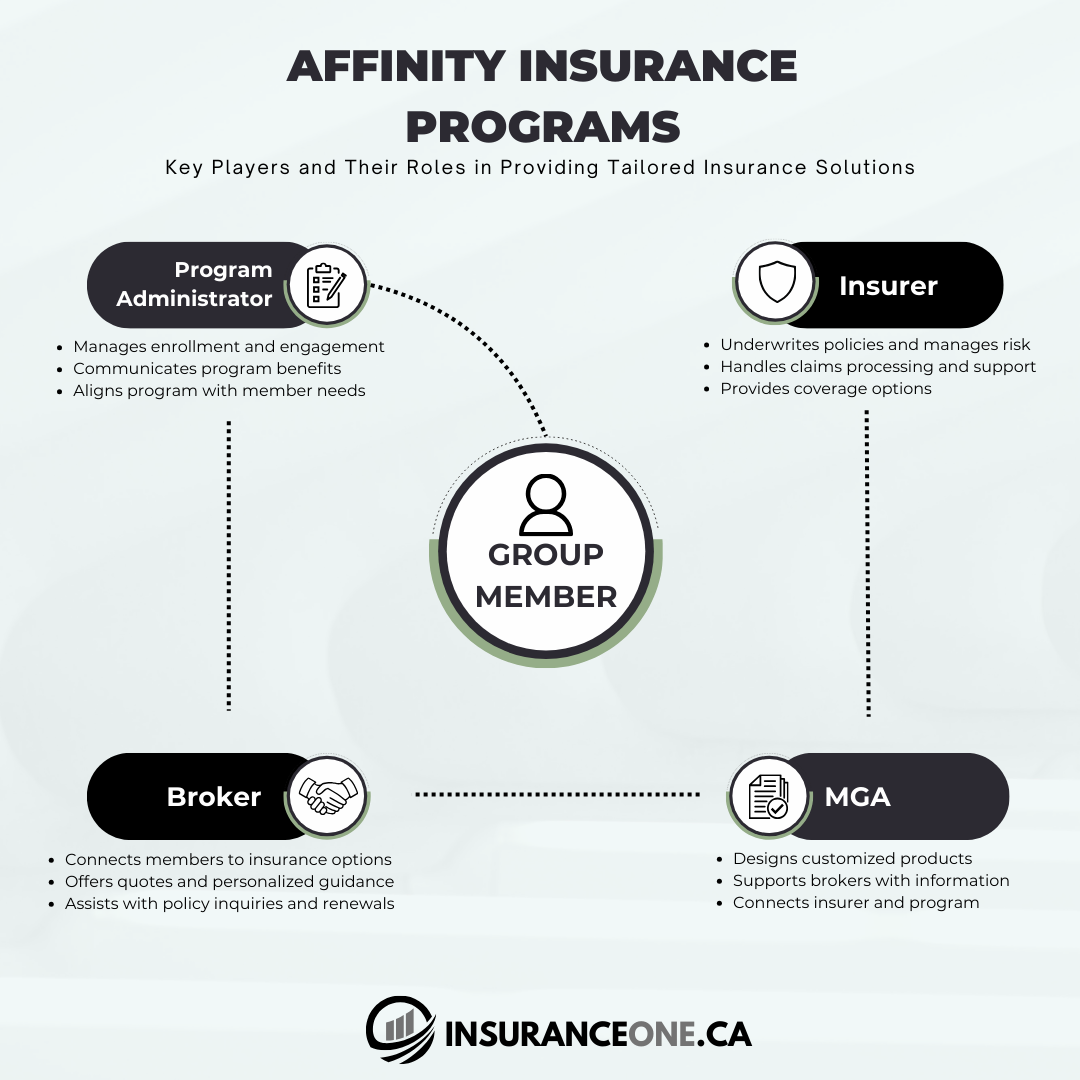

Key Players in the Affinity Program Ecosystem

Understanding the main players in an affinity program helps clarify how these programs operate and the value each participant brings to the group. Here’s a look at each role:

-

- Insurer: Underwrites policies and manages claims, ensuring that coverage is comprehensive and meets the group’s needs.

- MGA (Managing General Agent): Acts as a specialized intermediary, helping design and adjust products to suit the unique needs of the affinity group.

- Broker: Connects members with the insurer’s offerings, provides quotes, and assists with questions about coverage.

- Program Administrator: Represents the affinity group and ensures smooth enrollment and communication with members.

- Affinity Members: Enjoy access to customized insurance options and services tailored to their group’s specific requirements.

How Each Player Interacts

Affinity programs require coordination between multiple players, each contributing their expertise to deliver a cohesive insurance experience:

-

- Insurer and MGA: Work together to design products that meet the group’s risk profile, creating coverage options that are tailored to the group’s unique needs.

- MGA and Broker: The MGA assists the broker in understanding product features, enabling them to present tailored options to members in a clear, accessible way.

- Broker and Program Administrator: Collaborate to ensure members are well-informed and that the program aligns with the group’s needs, providing clarity and consistency.

- Program Administrator and Members: The administrator communicates program details and manages enrollment, helping members understand and access their coverage effectively.

Challenges in Managing Affinity Programs

Despite the many advantages, affinity programs come with challenges, such as:

-

- Coordination Among Players: Insurers, brokers, administrators, and members must communicate effectively to stay aligned and informed.

- Data Management: Managing and sharing sensitive member data accurately across various participants requires robust processes to ensure data integrity and confidentiality.

- Consistency in Member Experience: Delivering a cohesive experience can be challenging if each player operates separately, which can lead to service gaps.

These challenges underscore the importance of a well-coordinated approach to deliver a unified experience for members.

The Value of a Unified Approach

For an affinity program to reach its full potential, a unified approach that connects all participants can make a big difference. When data flows smoothly and each player interacts seamlessly, affinity programs become more efficient, ensuring a positive member experience and streamlined operations for everyone involved.

A unified system allows for:

-

- Efficient Data Sharing: All participants access real-time information, ensuring accurate quotes, timely support, and up-to-date policy information.

- Seamless Member Experience: Members experience smooth transitions across enrollment, policy management, claims, and renewals.

- Improved Coordination: Program administrators, brokers, and insurers work together effortlessly, enhancing the program’s overall effectiveness and alignment with group needs.

By adopting a unified approach, organizations can overcome operational challenges, creating a streamlined solution that maximizes value for everyone involved.

Affinity programs are a powerful strategy for organizations to deliver customized insurance solutions that foster loyalty and add meaningful value. By understanding the players involved, the benefits they provide, and the importance of coordination, organizations can build successful affinity programs that stand out in today’s competitive insurance landscape.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

What If Canada Became the 51st State?

Exploring the Impact on Canada's Property & Casualty Insurance Industry in a Hypothetical U.S....

2024 Insurance Wrapped

2024 Wrapped: The Year That Shaped Canadian Insurance As the calendar turns to 2025, we reflect on...

GenAI for Insurance Professionals

Generative AI is reshaping industries at an unprecedented pace, and the insurance sector is no...

Getting Started in Insurance: Education Paths for Students and Graduates

Insurance plays a vital role in supporting individuals, businesses, and communities worldwide....

Claims + AI: The Good, The Bad, and The Ugly

Trigger Warning and Disclaimer The following article discusses sensitive topics, including a...

November 2024 MGA Roundup: A Glimpse Into 12 Canadian MGAs

As the year winds down, we’re taking a moment to spotlight 12 Canadian MGAs and their recent...

8 Cyber Threat Categories: What You Need to Know

The Need for Cyber Insurance In today’s interconnected world, cyber threats pose a significant...

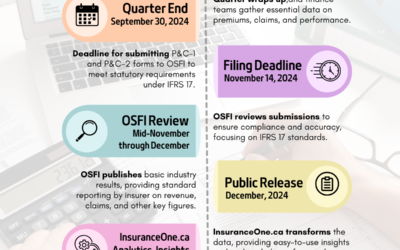

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and...

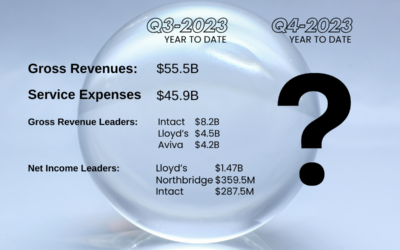

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on...

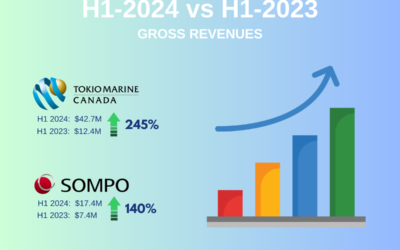

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property &...