The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty (P&C) insurance sector, with total net profits after taxes reaching $5.3 billion. Domestic insurers contributed $2.5 billion, while foreign entities added another $2.8 billion, demonstrating the sector’s profitability across markets.

Lloyd’s led the pack with the highest net profits, showcasing its ability to operate efficiently and capture market value. Canadian insurers like Wawanesa and Intact also posted solid profits, reflecting their resilience and strategic positioning. Foreign participants, including Northbridge and Allstate, continued to solidify their presence through effective underwriting and cost control strategies.

As the industry navigates evolving market dynamics, profitability metrics highlight the insurers best positioned for sustainable growth. With total pre-tax profits nearing $6.5 billion, the sector continues to demonstrate financial health, balancing revenue generation with cost management. These figures provide a forward-looking lens on which players are equipped to thrive in an increasingly competitive environment.

Q2-2024 Top 10 by Profit

This table showcases the top 10 Property & Casualty (P&C) insurers operating in Canada, ranked by net profit after taxes for Q2-2024. Alongside profits, it includes revenue figures and profit before taxes, providing a comprehensive view of the financial health and performance of the industry’s top players. Figures are reported in thousands of dollars.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

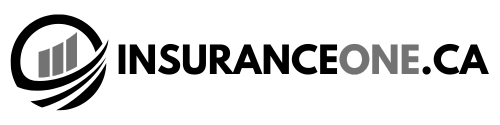

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and...

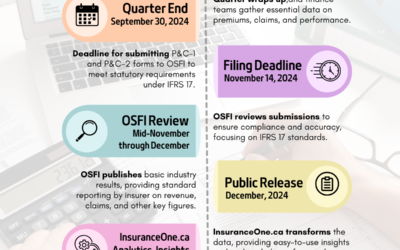

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on...

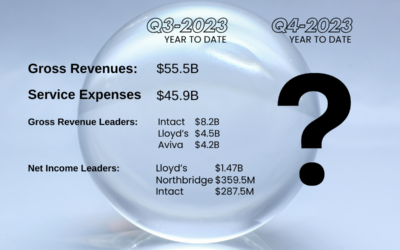

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property &...

Canada’s Top 10 P&C Insurers: Q2 2024 Revenue Leaders

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial...