Trigger Warning and Disclaimer The following article discusses sensitive topics, including a recent event involving violence. While the focus is on the broader implications of Artificial Intelligence (AI) in claims processing, the content may be upsetting to some readers.

This article is intended to explore the subject matter thoughtfully and does not claim to represent all perspectives or provide conclusions about any specific incident. The goal is to foster constructive dialogue while acknowledging the complexity of the issues involved.

Insurance Claims and Artificial Intelligence

The insurance industry is undergoing a profound transformation, driven in part by the integration of Artificial Intelligence (AI) into claims processing. While AI offers immense promise, its adoption raises critical questions about fairness, transparency, and human oversight.

Recent events, such as the shooting of UnitedHealthcare executive Brian Thompson, have reignited debates about claims handling and its emotional toll. According to reports, the assailant, who allegedly targeted Thompson, left shell casings engraved with words like “deny” and “defend,” phrases often associated with criticisms of insurance claims practices. This event highlights the intense scrutiny and emotional toll claims handling can have on both individuals and the broader industry.

The Good: Efficiency and Innovation

AI is revolutionizing claims processing in ways that would have been unthinkable just a decade ago. Some of the most significant advantages include:

Faster Claims Processing

AI enables insurers to automate repetitive tasks, such as data validation and documentation review. By reducing processing times from days to minutes, AI enhances customer satisfaction and streamlines operations.

Improved Fraud Detection

Fraud has long been a significant challenge for insurers. Machine learning models can identify suspicious patterns in real time, flagging claims for further investigation and saving billions of dollars annually.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants provide policyholders with instant updates, assistance in filing claims, and status tracking. These tools make the claims process more transparent and accessible.

The Bad: Where Challenges Emerge

For all its benefits, AI in claims processing is not without drawbacks. Key concerns include:

Reduced Human Interaction

Automation, while efficient, often eliminates the personal touch many customers value during stressful situations. A chatbot may be informative, but it cannot empathize with someone navigating a loss.

Algorithmic Errors

Even sophisticated AI systems are only as good as the data they are trained on. Flawed or biased data can lead to inaccurate claims decisions, creating frustration for customers and reputational risks for insurers.

Job Displacement

As automation takes over more tasks, the workforce is inevitably affected. While AI creates efficiencies, it also raises ethical concerns about the balance between profitability and employment.

The Ugly: Ethical and Emotional Consequences

The recent shooting of UnitedHealthcare executive Brian Thompson has drawn attention to the intense emotions tied to claims handling. This event underscores the importance of ensuring that claims processes remain transparent, fair, and empathetic.

AI’s Role in Controversies

AI, when improperly implemented, can exacerbate frustrations. Automated denials based solely on predictive models or cost-saving algorithms can feel impersonal and unjust to claimants. This highlights the critical need for:

-

- Human Oversight

Claims decisions that directly impact individuals’ lives should not rely solely on machines. Combining AI’s efficiency with human judgment ensures that each case receives the nuanced attention it deserves. - Ethical AI Practices

Insurers must prioritize fairness by auditing algorithms regularly, minimizing biases, and explaining how decisions are made. - Transparency

Policyholders need clear communication about how AI is used in their claims. This builds trust and helps mitigate misunderstandings.

- Human Oversight

Striking a Balance: The Path Forward

Artificial Intelligence (AI) holds immense potential to revolutionize claims processing, but thoughtful implementation is essential. Insurers need to find the right balance between achieving efficiency and maintaining empathy. While automation can streamline operations, human oversight is crucial to ensure that individual cases are handled with care and understanding.

Innovation must also be guided by a strong sense of ethical responsibility. Transparent communication about how AI tools are used in claims processing can foster trust among policyholders and mitigate concerns about fairness and bias.

As AI continues to advance, insurers have a unique opportunity to harness this technology as a powerful tool for positive change. Claims handling should go beyond operational goals to prioritize trust, transparency, and the human element that forms the foundation of the insurance industry. By doing so, insurers can strengthen their relationships with customers and set a higher standard for the industry as a whole.

Additional Resources

For those interested in exploring this topic further, here are some resources that provide insights into the international and Canadian perspectives on AI in claims processing:

Canada’s insurers: Protecting Canadians in times of change and challenge (Insurance Bureau of Canada): An overview of how AI is shaping insurance claims in Canada and the associated regulatory challenges. Read more

Insurance 2030—The impact of AI on the future of insurance (McKinsey & Company): A global perspective on ethical AI implementation in insurance. Read more

Responsible AI in Insurance (RSM US): Guidance on adopting AI responsibly to balance innovation with ethical considerations in insurance. Read more

The Impact of Big Data and Artificial Intelligence (AI) in the Insurance Sector (OECD): A detailed exploration of AI’s role in detecting fraud and its implications for consumers. Read more

Artificial Intelligence (AI) (Government of Canada): Understanding how AI regulations impact the insurance sector. Read more

Automated Claims Processing in Insurance (EY): Insights into how a Nordic insurer successfully automated claims handling with AI. Read more

Consumer trust is the key to realising AI’s full potential (World Economic Forum): A discussion on building transparency and trust in AI-driven decisions. Read more

Customer Service: How AI Is Transforming Interactions (Forbes): Insights into how AI is reshaping customer interactions. Read more

The Case for AI in Insurance (Harvard Business Review): How AI improves decision-making and operational efficiency in insurance. Read more

Generative AI in Insurance Distribution (Bain & Company): Exploring how generative AI is revolutionizing insurance sales and distribution. Read more

Support Resources

If you or someone you know is impacted by challenges related to claims processes or mental health, the following resources may provide support:

Mental Health Support:

- Wellness Together Canada

- Crisis Services Canada

- WHO Mental Health Support

- BetterHelp Online Counseling

- MentalHealth.gov (US)

Insurance Assistance:

- General Insurance OmbudService (GIO)

- Financial Ombudsman Service (UK)

- Consumer Financial Protection Bureau (US)

- National Association of Insurance Commissioners (US)

Ethics and AI Resources:

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

Latest Articles and Insights

Q4 2024 Canadian P&C Results and Insights

The Canadian Property & Casualty (P&C) insurance industry capped off 2024 with another...

Friday FunDay Game for February 14, 2025

💘 Friday Funday: Love & Risk – The Insurance Edition! 💘 This week, we’re celebrating...

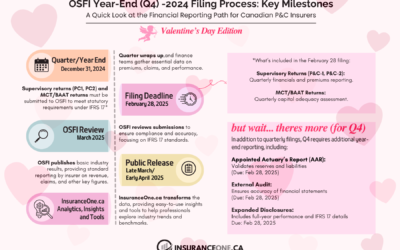

OSFI Filing Day Alert: February 28 is Around the Corner!

The year-end rush is over, and now it’s time for Canadian P&C insurers to focus on year-end...

What If Canada Became the 51st State?

Exploring the Impact on Canada's Property & Casualty Insurance Industry in a Hypothetical U.S....

Friday FunDay Game for January 24, 2025

Welcome to this week’s Friday Funday! We're switching things up this week with "Playing with...

Crossword Puzzle for January 17, 2025

Welcome to this week’s Friday Funday! Dive into our latest insurance-themed crossword puzzle,...