Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and casualty (P&C) insurers, a critical milestone for finance teams. The deadline, which falls 45 days after the end of the quarter, shifts the focus from internal management reports to the statutory filings required by the Office of the Superintendent of Financial Institutions (OSFI). While many insurers have already shared their Q3 results with shareholders, today’s task is to meet the exacting regulatory standards set by OSFI.

With IFRS 17 now fully in effect, these filings require greater precision and compliance. This new accounting standard demands more detailed reporting on insurance contracts, adding complexity to the process. Insurers must submit their official forms to OSFI, ensuring accuracy and adherence to these updated standards. For many finance teams, this means finalizing results after weeks of preparation, often under tight deadlines. For some, a little extra coffee ☕ might be necessary to cross the finish line.

This process ensures that the data shared with OSFI is consistent, accurate, and compliant with regulatory standards. As these filings are scrutinized for accuracy, the finance teams’ dedication and effort play a critical role in maintaining the transparency and stability of the industry.

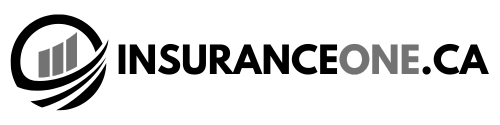

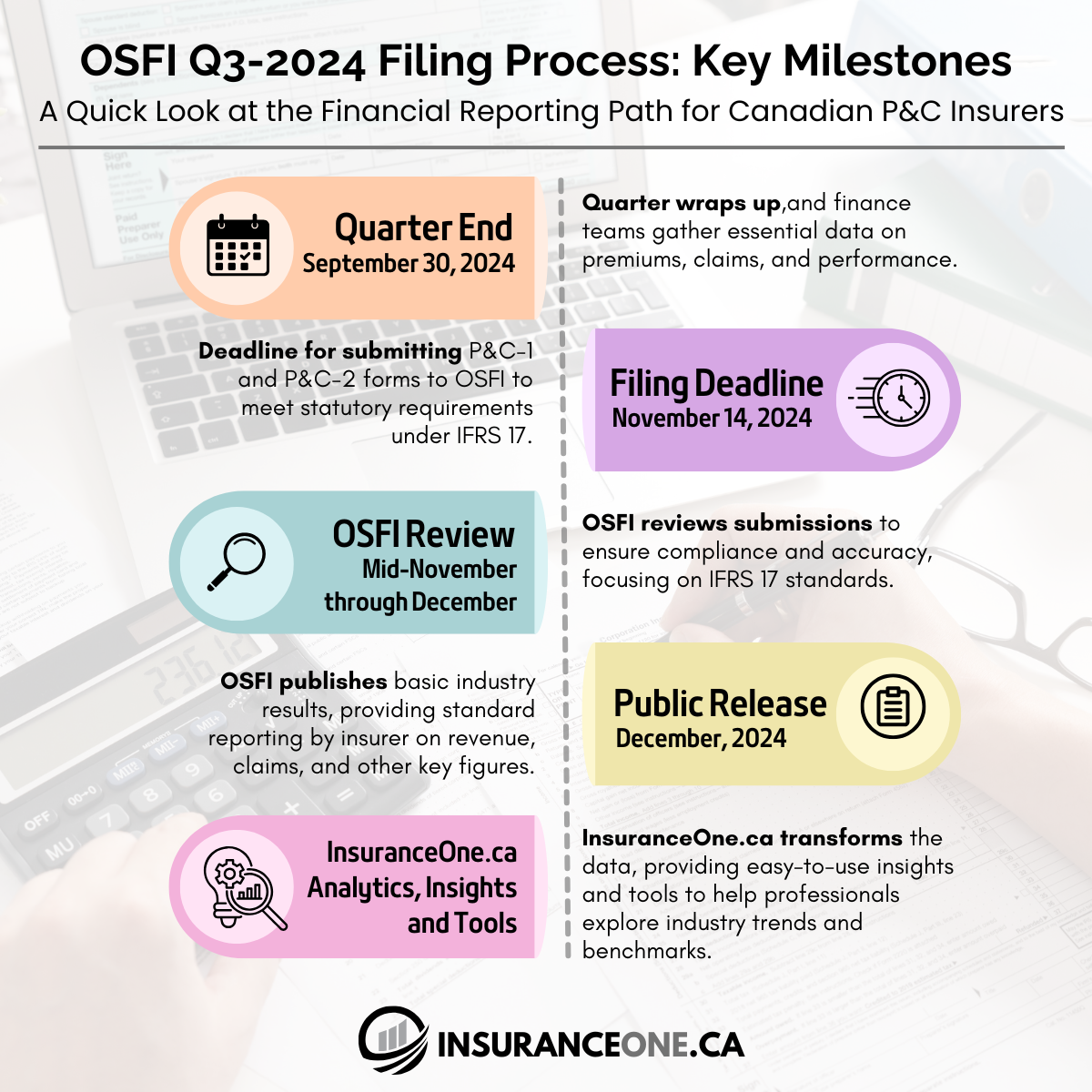

How the Filing Process Unfolds:

The filing process is divided into clear steps that ensure both timely submission and regulatory compliance. Here’s how it typically unfolds:

📅 September 30: The end of Q3 marks the beginning of the filing period. Finance teams immediately begin gathering and organizing key data related to premiums, claims, expenses, and other financial metrics. This stage is crucial for creating accurate and comprehensive reports.

📈 November 14, 2024: Statutory Filing Deadline. This is the day when insurers must submit their official filings to OSFI. Included in these submissions are the P&C-1 and P&C-2 forms, which play a critical role in ensuring transparency and compliance:

-

- P&C-1: This form offers a high-level overview of the insurer’s financial position, including essential financial statements like the balance sheet and income statement. This document is central to OSFI’s review process and serves as the foundation for understanding an insurer’s financial health.

- P&C-2: This form goes deeper, providing a detailed look at an insurer’s operations. It includes information on claims development, underwriting activities, and reinsurance arrangements. P&C-2 is essential for OSFI to assess the operational risks and performance of the insurer.

Both of these forms are required by OSFI and must be submitted by the deadline to ensure compliance with regulatory standards. The filings are also made in accordance with IFRS 17, which is a new standard for accounting for insurance contracts. IFRS 17 requires insurers to report more detailed information about their insurance contracts, providing greater transparency to stakeholders.

🔍 OSFI Review: After the filings are submitted, OSFI begins its review process. This is when the data submitted by insurers is cross-checked for accuracy and compliance with the new IFRS 17 standards. OSFI’s role is to verify that the reported data is consistent, correct, and adheres to established guidelines. The review can take several weeks, and insurers may be asked to provide additional information if needed.

📢 Early December: Following the review period, OSFI will publicly release the Q3 results. This public release provides industry-wide data on revenue, claims, profitability, and other key metrics, offering valuable insights into the performance of the Canadian P&C insurance market. This is an important moment for the industry, as it helps stakeholders and analysts understand broader trends and benchmarks in the market.

📊 Shortly After OSFI’s Release: Once the OSFI data is publicly available, InsuranceOne.ca aggregates and analyzes the latest industry data. We then transform this data into actionable insights and easy-to-use tools that help industry professionals stay informed. Our insights focus on trends, benchmarks, and key metrics, helping insurers, brokers, and other stakeholders make more informed decisions based on the latest data.

A Moment for Finance Teams

It’s important to recognize the hard work that goes into these submissions. The finance teams behind the scenes work tirelessly to ensure that all data is accurate, compliant, and submitted on time. If you’re part of a finance team, or know someone who is, now is a great time to show some appreciation for the long hours and dedication that go into this process.

The Q3 filing deadline caps off weeks of data wrangling, regulatory review, and internal coordination. It’s not an easy task, but it is a critical one that ensures transparency, compliance, and accuracy across the industry. For those in the finance departments, today is a major milestone, but it also marks the beginning of another important step in maintaining the stability and accountability of the P&C insurance industry.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

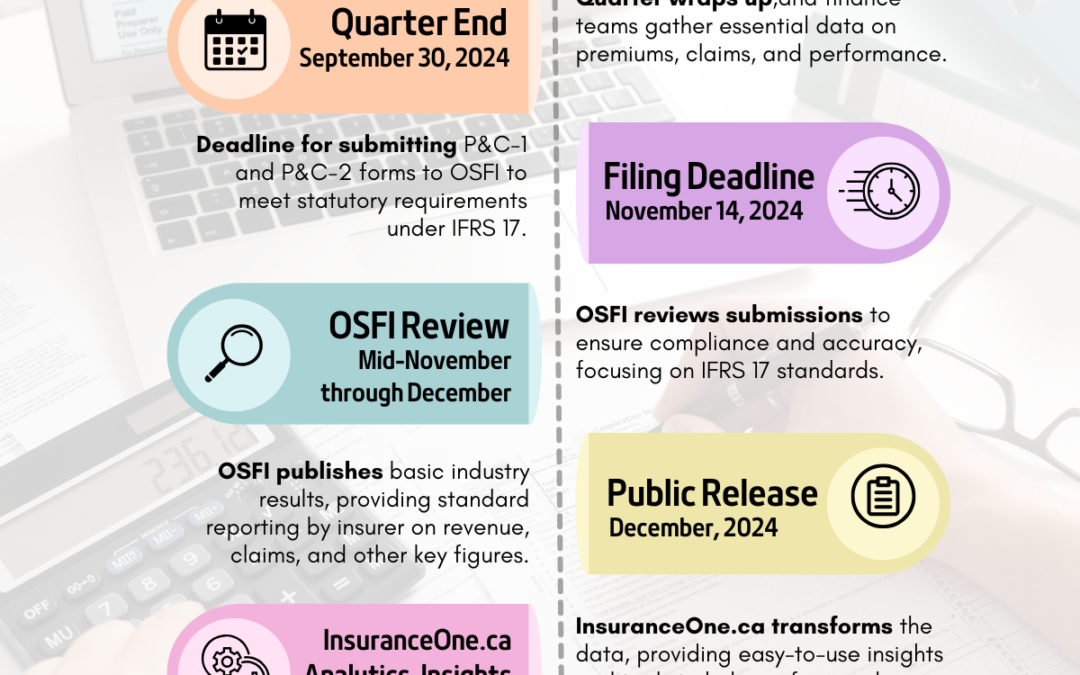

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on...

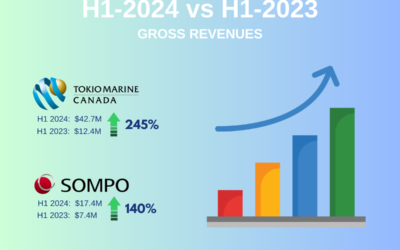

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property &...

Canada’s Top 10 P&C Insurers: Q2 2024 Profit Leaders

The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty...

Canada’s Top 10 P&C Insurers: Q2 2024 Revenue Leaders

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial...