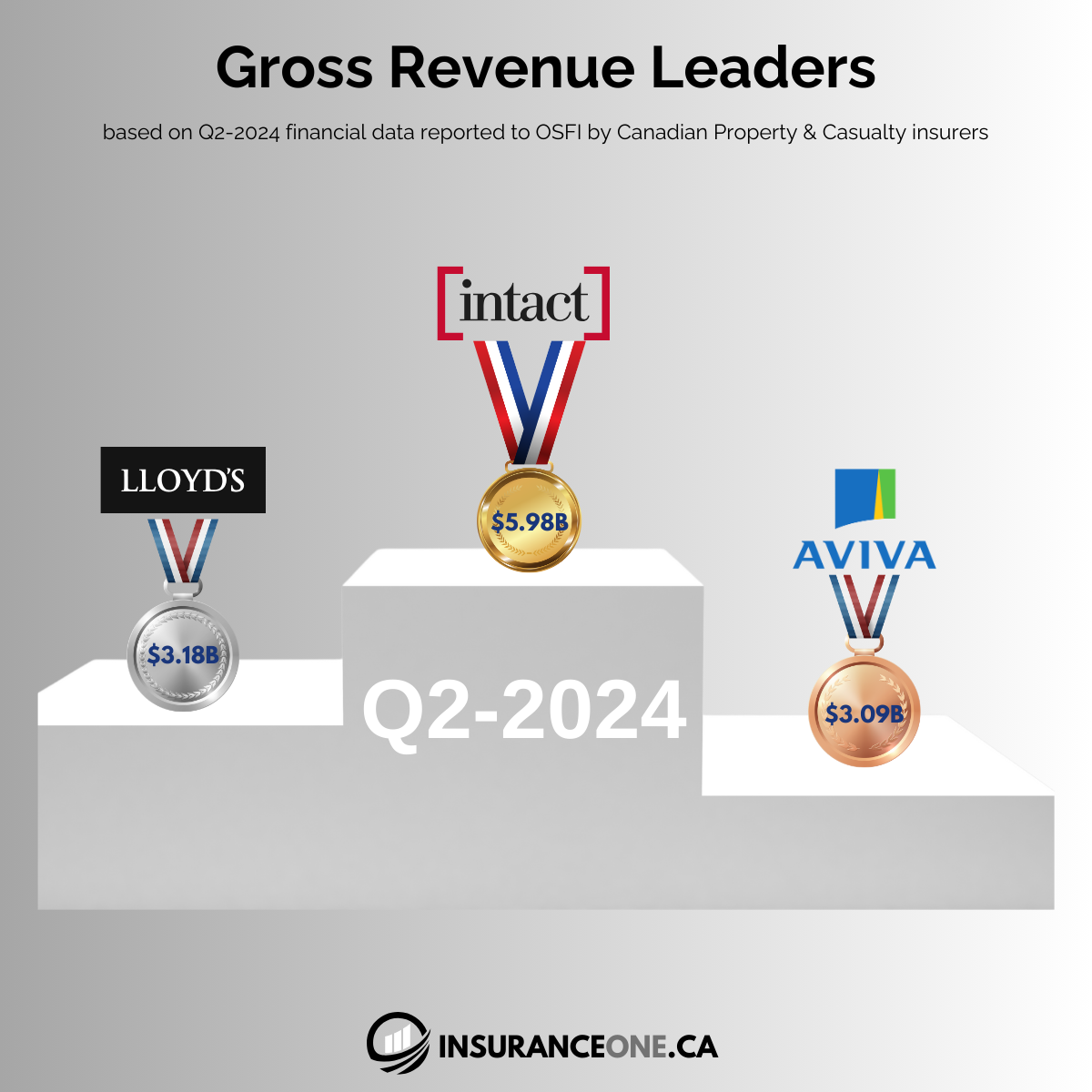

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial revenue growth, reaching a year-to-date total of $42.2 billion. Domestic insurers led with $32.5 billion, while foreign entities contributed $9.7 billion. Intact Financial Corporation emerged as the top revenue earner with $5.98 billion, capturing a significant 14.2% market share. Following closely, Lloyd’s reported $3.18 billion in revenues, and Aviva rounded out the top three with $3.09 billion, underscoring their strong market presence.

Other major players, including Co-operators, Definity, and Security National, also posted notable revenues, reflecting the competitive and dynamic landscape of Canada’s insurance sector. As companies navigate shifting economic conditions, these revenue figures offer insights into market positioning and potential growth trajectories.

For a deeper look into profitability rankings, see our Top 10 Profit Leaders article. Together, these insights reveal how Canada’s top insurers are managing growth and preparing for future challenges within the P&C market.

These mid-year figures highlight the competitive dynamics within the industry, providing insights into which players are consolidating their market positions and which may face pressure to innovate or expand. As the industry navigates shifting economic conditions and evolving consumer expectations, the strategies adopted by these key players will shape the outlook for the remainder of 2024.

Q2-2024 Top 10 by Revenue

This table highlights the top 10 Property & Casualty (P&C) insurers operating in Canada, ranked by gross revenue for Q2-2024. In addition to revenue, it provides a comparison of profit before and after taxes, offering deeper insights into the financial performance of leading insurers. Figures are reported in thousands of dollars.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

More Canadian P&C Insights, Results, and Articles

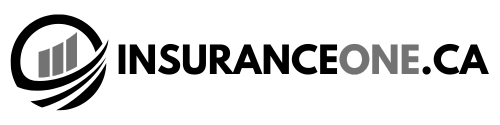

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and...

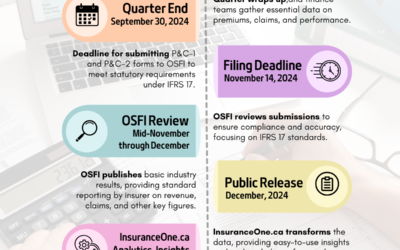

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on...

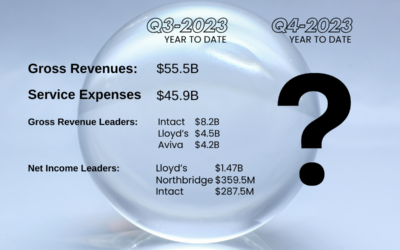

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property &...

Canada’s Top 10 P&C Insurers: Q2 2024 Profit Leaders

The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty...