The Q3 2024 year-to-date (YTD) results for reinsurance companies, derived from OSFI-regulated financial data, provide a comprehensive look into the sector’s performance under the IFRS 17 framework. The reinsurance industry remains a cornerstone of global risk management, enabling insurers to share risk through reinsurance treaties and facultative agreements. By providing additional capacity, reinsurers allow insurers to underwrite larger policies, manage exposures, and maintain financial stability in the face of significant claims.

Reinsurers play a vital role in absorbing losses from catastrophic events like natural disasters, ensuring that insurers can remain solvent and continue supporting policyholders during crises. Beyond catastrophe coverage, they provide critical support for navigating emerging risks, including climate change, cyber threats, and economic uncertainties.

While Q3 2024 results revealed growth for some reinsurers, others faced rising service expenses and profitability pressures. These results highlight the sector’s resilience and adaptability amid an increasingly complex and challenging market landscape.

The following analysis highlights the key trends and performance drivers for the reinsurance market in Q3 2024.

Key Insights and Highlights

- Revenue leaders such as Everest Reinsurance Company and Swiss Re. maintained their dominance, showcasing their ability to adapt to global market shifts. Everest led the sector with 14.18% YoY revenue growth, achieving total revenues of $503.850 million, up from $441.288 million in Q3 2023. Swiss Re followed closely with a steady 8.02% growth, reaching $462.425 million in revenues.

- Smaller players like Starr Insurance & Reinsurance Limited posted a strong 16.01% YoY increase in revenues, reflecting effective operational strategies, rising from $348.495 million in Q3 2023 to $403.852 million in Q3 2024. Meanwhile, companies like Toa Reinsurance Company of America faced a -20.95% YoY decline, underscoring operational challenges and a tough market environment.

- Service expenses surged for some companies. Swiss Re Corporate Solutions America Insurance Corporation reported an extraordinary 941.09% YoY increase in service expenses, while Munich Reinsurance Company of Canada saw a sharp rise of 523.85%. These jumps reflect rising operational costs in certain regions. In contrast, Toa Reinsurance Company of America achieved a notable -36.43% YoY decrease in service expenses, showcasing cost containment measures.

- Profitability varied across the sector. Everest Reinsurance Company, despite strong revenue growth, experienced a 45.55% drop in Profit After Tax, falling to $22.307 million, down from $40.986 million in Q3 2023. On the other hand, Starr Insurance & Reinsurance Limited delivered a standout performance, reporting a 53.15% YoY growth in Net Income, rising to $29.371 million from $19.485 million.

- Smaller players like Mapfre Re Compania de Reaseguros, S.A., despite modest revenues, showed resilience with notable YoY percentage increases in Profit After Tax. These performances underscore the sector’s diversity as companies navigate unique market dynamics.

Sector Growth Drivers:

- Growing demand for comprehensive risk management solutions, driven by climate-related challenges and natural catastrophe exposures.

- Rising service expenses for many companies, which placed pressure on overall profitability.

- Revenue concentration among top players, reflecting their ability to capture market opportunities and adapt to shifting economic conditions.

Sector Outlook:

The reinsurance sector remains a cornerstone of global risk management, but the path forward will require balancing cost pressures with revenue growth. Larger players are well-positioned to leverage their scale and financial strength, while smaller companies must embrace innovation and agility to stay competitive.

The adoption of IFRS 17 standards continues to enhance transparency and comparability, providing the industry with a stronger foundation for data-driven insights. As companies adjust to these changes, success will hinge on strategic cost control, effective underwriting, and robust investment results.

Q3-2024 YTD P&C Reinsurer Results

This table shows the 2024-Q3 YTD financial results for Property & Casualty (P&C) reinsurers operating in Canada, Figures are reported in thousands of dollars.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

Latest Data Insights from OSFI Reporting

Q2 2024 Canadian P&C Results and Insights

The Q2 2024 results, based on OSFI-reported data, reflect steady financial performance across Canada’s Property & Casualty (P&C) insurance...

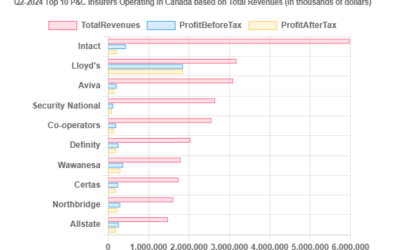

Canada’s Top 10 P&C Insurers: Q2 2024 Profit Leaders

The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty (P&C) insurance sector, with total net profits after...

Canada’s Top 10 P&C Insurers: Q2 2024 Revenue Leaders

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial revenue growth, reaching a year-to-date total of...

Latest Articles

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.