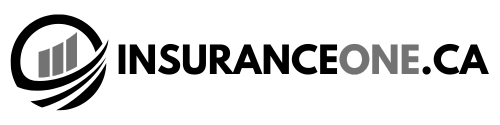

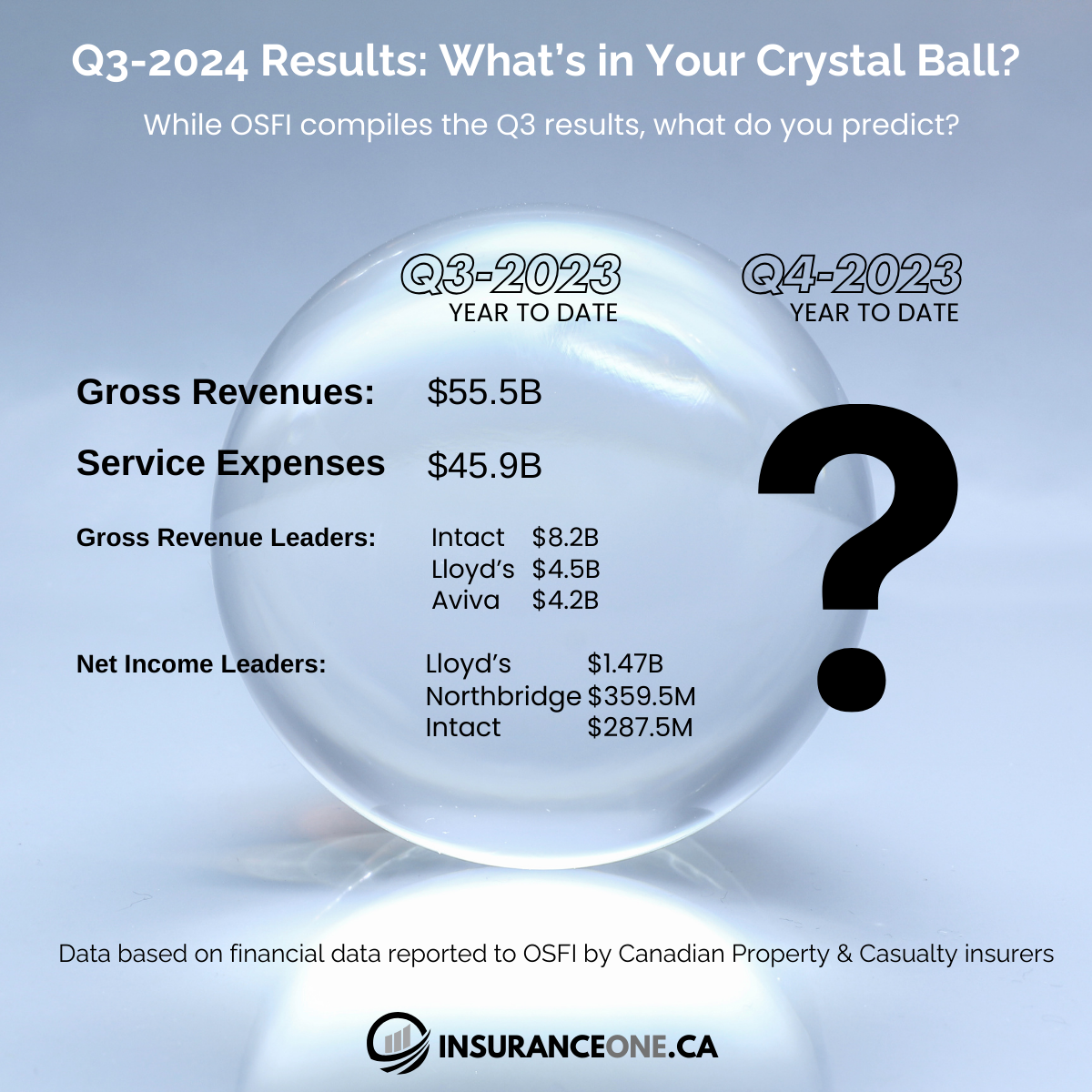

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on last year’s Q3-2023 year-to-date performance in Canada’s Property & Casualty (P&C) insurance sector under IFRS17 standards.

Last year, some major players reported substantial gross revenues, with companies like Intact, Lloyd’s, and Aviva leading the pack.

While individual companies have already publicly shared some Q3-2024 data, the full industry picture is still taking shape. So, grab your crystal ball 🔮 and let’s hear from you:

What Are Your Predictions?

💰 What will be the overall gross revenue for Canada’s P&C sector?

🏆 Which companies will come out as revenue leaders this year?

📈 Who do you expect to lead in profitability?

🔄 Are any big shifts among the top players on the horizon?

📉 Will we see an increase or decrease in loss expenses?

Last Year’s Q3 YTD Highlights:

Revenue Leaders: Top companies like Intact Insurance Company and Aviva Insurance Company of Canada drove significant growth, setting high standards for revenue performance.

Service Expenses: Based on last year’s reports, service expenses mainly represented claims processing and policy servicing costs, reflecting the operational investments insurers make to support claims and client needs in real-time.

Follow us on LinkedIn and subscribe at InsuranceOne.ca for our Q3-2024 recap as soon as OSFI releases the results. We’ll bring you data and insights focused on IFRS17-compliant insurers reporting under OSFI. Note: OSFI results may exclude some national insurers regulated by other agencies, such as the AMF in Québec.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

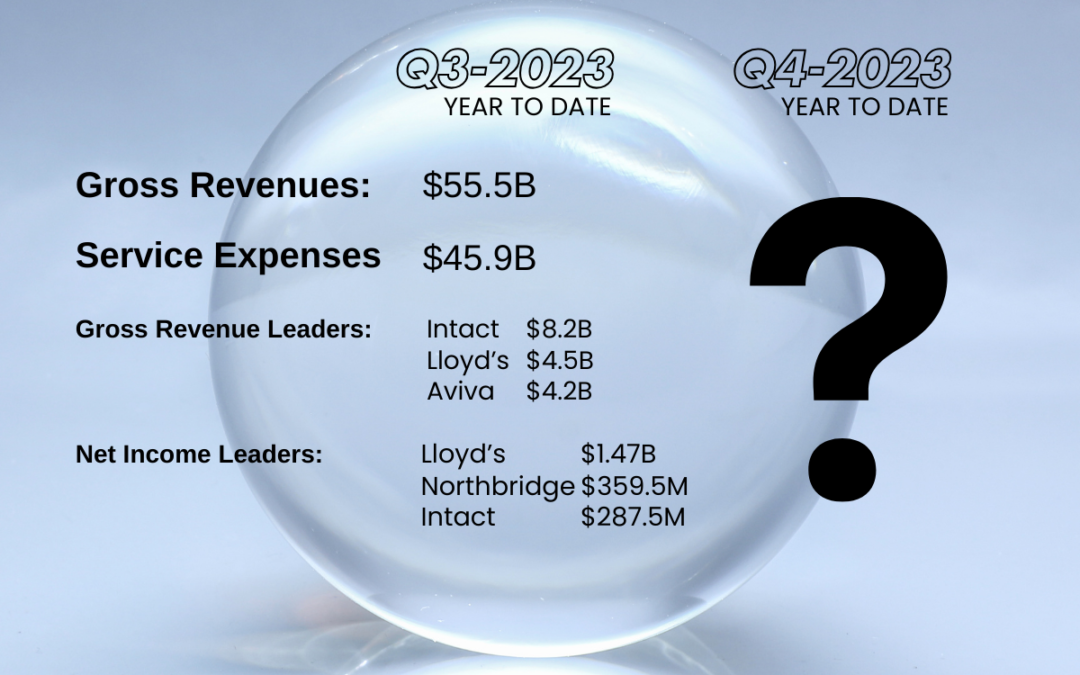

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and...

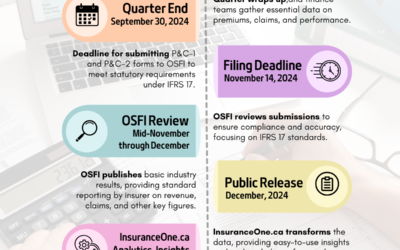

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property &...

Canada’s Top 10 P&C Insurers: Q2 2024 Profit Leaders

The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty...

Canada’s Top 10 P&C Insurers: Q2 2024 Revenue Leaders

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial...