InsuranceOne.ca

Canadian Insurance Insights & Analytics

Latest Insights, Results, and Articles

Q4 2024 Canadian P&C Results and Insights

The Canadian Property & Casualty (P&C) insurance industry capped off 2024 with another quarter of robust financial performance. Based on...

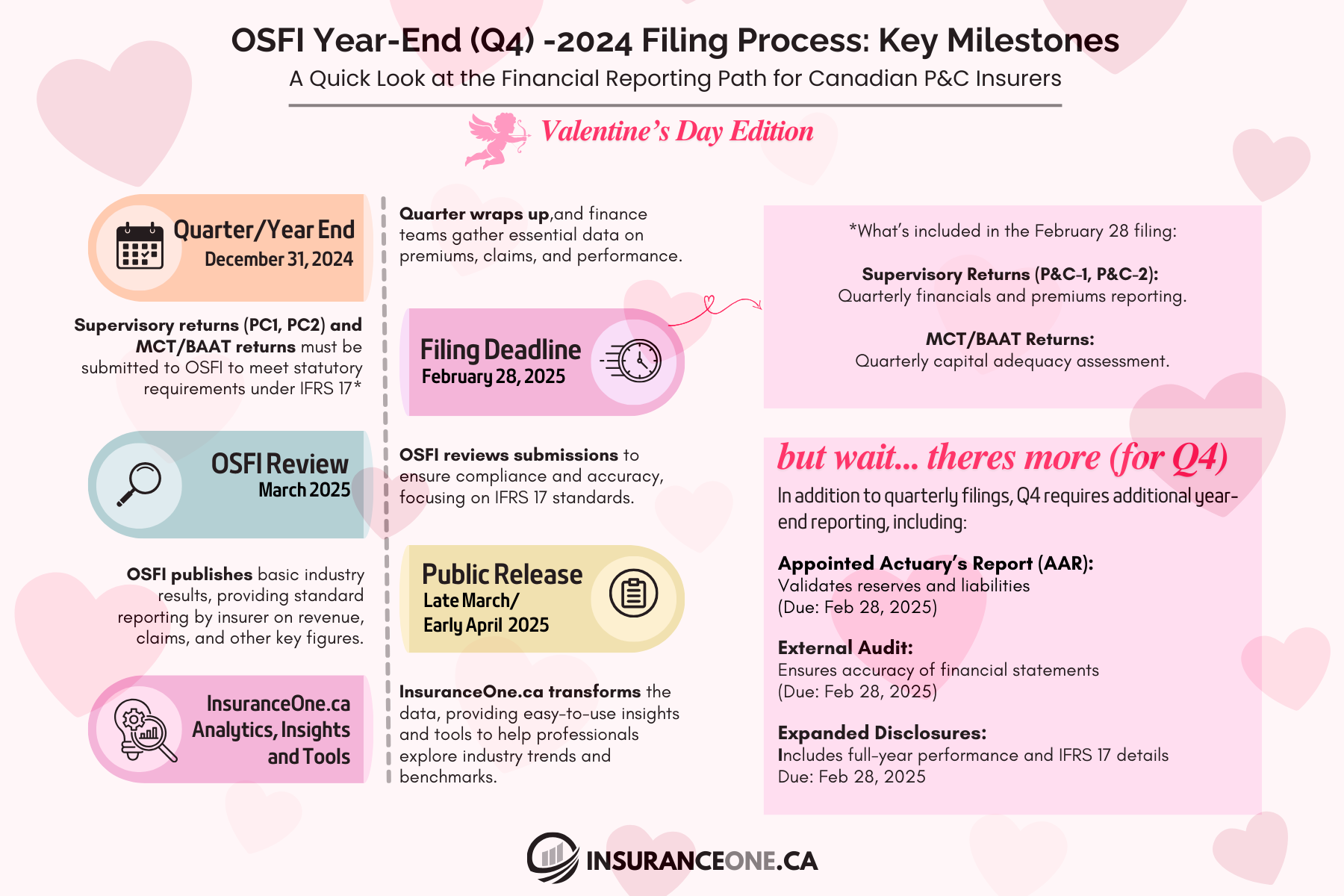

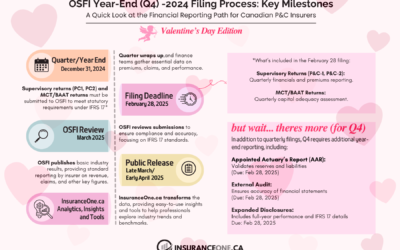

OSFI Filing Day Alert: February 28 is Around the Corner!

The year-end rush is over, and now it’s time for Canadian P&C insurers to focus on year-end OSFI filings. While every quarter has its...

What If Canada Became the 51st State?

Exploring the Impact on Canada's Property & Casualty Insurance Industry in a Hypothetical U.S. MergerWith recent headlines speculating about...

2024 Insurance Wrapped

2024 Wrapped: The Year That Shaped Canadian Insurance As the calendar turns to 2025, we reflect on a transformative year for the Canadian insurance...

GenAI for Insurance Professionals

Generative AI is reshaping industries at an unprecedented pace, and the insurance sector is no exception. By leveraging GenAI, professionals can...

Q3 2024 Canadian P&C Reinsurance Results

The Q3 2024 year-to-date (YTD) results for reinsurance companies, derived from OSFI-regulated financial data, provide a comprehensive look into the...

Getting Started in Insurance: Education Paths for Students and Graduates

Insurance plays a vital role in supporting individuals, businesses, and communities worldwide. With diverse roles ranging from risk management to...

Claims + AI: The Good, The Bad, and The Ugly

Trigger Warning and Disclaimer The following article discusses sensitive topics, including a recent event involving violence. While the focus is on...

November 2024 MGA Roundup: A Glimpse Into 12 Canadian MGAs

As the year winds down, we’re taking a moment to spotlight 12 Canadian MGAs and their recent activities. From awards and recognitions to innovative...

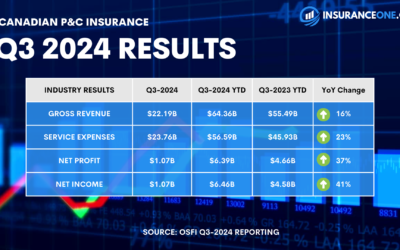

Q3 2024 Canadian P&C Results and Insights

The Q3 2024 year-to-date (YTD) results, based on OSFI-reported data, underscore the continued growth and resilience of Canada’s Property &...

Canadian Property & Casualty Insurance Channels

Insurers

Insurers provide policies that protect individuals and businesses from financial risks, offering coverage for everything from property to liability. They play a crucial role in safeguarding against unexpected losses. Browse our directory to explore trusted insurers.

MGAs

Managing General Agents (MGAs) act as intermediaries between insurers and brokers, offering specialized products and handling policy administration. Their expertise helps expand access to niche insurance solutions. Discover leading MGAs in our directory.

Brokers

Brokers guide clients through insurance options, connecting them with coverage tailored to their needs. Their market knowledge ensures the best policies and fair pricing. Explore experienced brokers in our directory.

Supporting Network

Reinsurers

Reinsurers back insurers by sharing risks for large or catastrophic events. This support enables insurers to offer higher coverage limits and maintain market stability. Explore our reinsurer directory to find key partners.

Adjusters (TPAs)

Adjusters, also known as Third-Party Administrators (TPAs), assess damages and manage claims to ensure fair outcomes. They work closely with both insurers and policyholders to resolve disputes efficiently. Browse our directory of adjusters.

Restoration

Restoration companies repair and rebuild properties after events like fires, floods, and storms. Their services help reduce losses and speed up recovery. Discover reliable restoration experts in our directory.

Over 200 Companies Indexed

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!