Generative AI is reshaping industries at an unprecedented pace, and the insurance sector is no exception. By leveraging GenAI, professionals can streamline workflows, enhance customer engagement, and unlock new levels of efficiency.

For those new to GenAI, this guide provides a primer designed to help you get started. You’ll learn what Generative AI is, how it differs from other AI systems, and why it’s particularly valuable in insurance. The article also highlights practical prompts, privacy and security best practices, and a breakdown of free, paid, and enterprise-level solutions to suit different needs.

What is Generative AI?

Generative AI (GenAI) is no longer a futuristic concept. Generative AI refers to artificial intelligence models that can generate content such as text, images, and code based on prompts. Unlike traditional AI systems, which are designed to analyze and process existing data, Generative AI creates new content. This makes it particularly valuable for creative and decision-support tasks.

How Does Generative AI Differ from Other AI?

Generative AI stands apart from other types of AI and automation technologies due to its ability to create entirely new content, rather than simply analyzing or processing existing data. For example, predictive analytics relies on historical data to forecast trends, while rule-based systems follow predefined instructions to automate specific processes. In the insurance industry, this might include:

-

Rating Algorithms: Used to calculate premiums based on pre-set formulas and criteria.

-

Underwriting Systems: Programmed to flag high-risk policies by comparing applications against standardized rules.

While these systems are powerful for repetitive tasks, they are constrained by existing data and logic. Generative AI, however, excels in creative and unstructured tasks. It can draft personalized emails, generate policy documents, or simulate customer interactions, making it a versatile tool for addressing challenges that traditional automation cannot handle effectively.

GenAI in the Insurance Industry

Generative AI is revolutionizing the insurance industry by enabling innovative solutions to long-standing challenges. It empowers professionals to automate repetitive tasks, like claims processing, while also offering creative approaches to customer engagement and risk assessment. By integrating GenAI into workflows, insurers can achieve greater efficiency, improved accuracy, and enhanced client experiences.

Whether it’s drafting personalized communications, generating detailed policy documents, or analyzing emerging trends, GenAI provides the tools to drive transformation across the industry. However, as with any advanced technology, its implementation must be approached responsibly, particularly when managing sensitive data or adhering to regulatory requirements.

Why Generative AI Matters in Insurance

Insurance is an industry that thrives on data, and GenAI excels at processing and synthesizing information to create meaningful insights. It’s particularly useful in:

-

Streamlining Operations: Automating repetitive tasks like claim triage and policy document drafting.

-

Enhancing Customer Service: Providing quick, accurate, and personalized responses to customer queries.

-

Supporting Decision-Making: Identifying market trends and generating actionable business strategies.

Whether you’re a claims adjuster, underwriter, or marketing professional, GenAI can empower you to work smarter and faster.

Practical Prompts to Get You Started with GenAI in Insurance

Policy Exclusions Simplification: Prompt: “Draft a simplified explanation of the exclusions in this insurance policy for a customer with no legal background. Break it up into easy to understand sections with practical examples.”

Customer Interaction Simulation: Prompt: “Simulate a customer asking about coverage for water damage, and provide responses in both a casual and professional tone.”

Claims Triage Optimization: Prompt: “Analyze these claim details and suggest if additional documentation might be required for faster resolution.”

Market Trend Insights: Prompt: “Summarize the top three emerging risks in commercial insurance for 2024 from these reports.”

Proposal Drafting: Prompt: “Generate a one-page summary for an insurance proposal targeting a small restaurant in Vancouver, Canada, with annual revenues of $500,000 and no more than three claims under $10,000 in the last five years.”

Risk Mitigation Advice: Prompt: “List five preventative measures for homeowners to reduce the risk of water damage claims.”

Broker Training Content: Prompt: “Create a training module for new insurance brokers on handling customer objections. Include example scenarios and solutions.”

Personalized Customer Outreach: Prompt: “Write a follow-up email for a customer who showed interest in our D&O online product but didn’t complete the application. Make the tone empathetic and include a call to action.”

Fraud Detection Support: Prompt: “Highlight potential red flags in this claim description based on typical fraud patterns and suggest next steps for investigation.”

SEO Marketing Content: Prompt: “Create a blog post title and outline targeting small business owners searching for ‘insurance for startups.’ Include FAQs they might have.”

These prompts are designed to inspire practical uses of GenAI in daily workflows, helping insurance professionals stay ahead in a competitive market.

Tips for Using GenAI Effectively

Iterative Prompt Building: Start with a simple prompt and refine it based on the results. Use follow-up prompts to clarify or expand on initial responses.

Leverage Memory: Tools like ChatGPT have contextual memory within a single session, allowing you to build on previous prompts for more detailed and nuanced outputs.

Combine Prompts and Tools: Use outputs from one tool as inputs for another. For example, draft a policy summary with ChatGPT, then create a visual presentation using another tool.

Stay Organized: Keep a repository of successful prompts for reuse and sharing across your team.

Free, Paid, and Enterprise GenAI Tools

GenAI tools come in different tiers based on features and pricing. Here’s a breakdown:

-

Free Tools: ChatGPT’s free version provides a robust starting point for generating text-based outputs. Great for individuals or small teams exploring AI.

-

Paid Plans: ChatGPT Plus ($20/month) offers access to GPT-4 with faster response times and improved capabilities. Ideal for professionals needing higher-quality outputs.

-

Enterprise Solutions: Tools like Microsoft Azure OpenAI Service provide enterprise-grade features, including security, scalability, and API access, tailored to organizational needs.

A Word of Caution: Privacy and Data Risks

While GenAI offers immense benefits, it’s crucial to be aware of the risks involved, especially regarding privacy and data security. Many GenAI tools are designed to improve over time by learning from user inputs, which means your data might be used for training purposes. To protect sensitive information, it’s important to understand how to disable such features when necessary.

Best Practices for Using GenAI Safely:

Avoid Pasting Confidential Data: Refrain from copying and pasting sensitive information such as policyholder details, claim data, or proprietary business information into GenAI tools.

Use Anonymized Data: When testing prompts, use generic or anonymized examples to protect real customer information.

Choose Secure Platforms: Opt for GenAI tools that offer robust security features, such as encryption and data isolation.

Turn Off Training Features: Learn how to disable data-sharing or training features in the GenAI tools you use to ensure sensitive information is not retained.

Verify Information: AI can sometimes provide inaccurate or misleading responses. Always cross-check critical information with trusted sources.

Beware of Plagiarism: When using AI-generated content, ensure that it is original and properly cite any sources that the AI may reference.

Consult Employer Policies: Different organizations and their CISOs may have specific rules regarding the use of GenAI. Always adhere to your employer’s guidelines and compliance requirements.

The Future of GenAI in Insurance

As GenAI continues to evolve, its potential in the insurance industry will only grow. Early adopters who use it responsibly will gain a significant edge, not only by optimizing processes but also by delivering superior customer experiences. By leveraging the right prompts and safeguarding data privacy, you can unlock the full potential of this transformative technology.

Ready to get started? Use the prompts above to experiment with GenAI in your workflows, and don’t forget to share your results with your team. Together, we can shape the future of insurance.

Popular GenAI Tools for Insurance Professionals

ChatGPT (OpenAI): https://chatgpt.com A conversational AI used for text generation, summarization, and customer interaction simulations. It’s widely applicable in claims processing and policy drafting.

Claude (Anthropic): https://www.anthropic.com/ Focuses on safety and ethical AI use, ideal for generating controlled responses and customer-facing content.

Microsoft Copilot: https://www.microsoft.com/en-us/microsoft-365/copilot Integrated with Microsoft products, Copilot assists in creating professional documents, presentations, and actionable insights for business operations.

Gemini (Google): https://gemini.google.com/ Previously known as Bard, Gemini is Google’s conversational AI chatbot. It offers advanced generative AI capabilities for tasks like writing, learning, and research, integrating seamlessly with Google tools.

Dialogflow (Google): https://cloud.google.com/dialogflow Specializes in building intelligent chatbots and virtual agents, enhancing automated customer service for insurance companies.

Additional GenAI Tools for Broader Applications

Jasper AI: https://www.jasper.ai/ Great for marketing professionals, helping with blog posts, ad copy, and content creation.

Writesonic: https://writesonic.com/ Ideal for quick drafting of articles, marketing material, and other written content.

Hugging Face Transformers: https://huggingface.co/ An open-source library for developers looking to customize natural language processing models.

Microsoft Azure OpenAI Service: https://azure.microsoft.com/en-us/products/cognitive-services/openai-service/ Offers enterprise-grade access to OpenAI models for secure and scalable implementations.

By segmenting these tools into categories, insurance professionals can focus on the most relevant GenAI options while exploring broader applications to enhance their operations.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

Latest Data Insights from OSFI Reporting

Q4 2024 Canadian P&C Results and Insights

The Canadian Property & Casualty (P&C) insurance industry capped off 2024 with another quarter of robust financial performance. Based on...

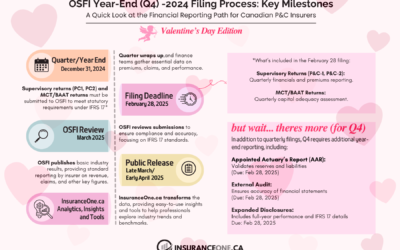

OSFI Filing Day Alert: February 28 is Around the Corner!

The year-end rush is over, and now it’s time for Canadian P&C insurers to focus on year-end OSFI filings. While every quarter has its...

Q3 2024 Canadian P&C Reinsurance Results

The Q3 2024 year-to-date (YTD) results for reinsurance companies, derived from OSFI-regulated financial data, provide a comprehensive look into the...

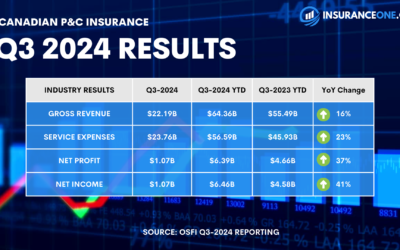

Q3 2024 Canadian P&C Results and Insights

The Q3 2024 year-to-date (YTD) results, based on OSFI-reported data, underscore the continued growth and resilience of Canada’s Property &...

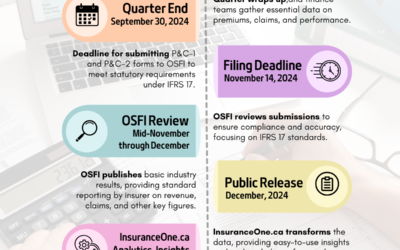

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and casualty (P&C) insurers, a critical milestone for...

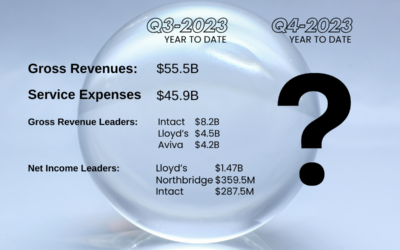

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on last year’s Q3-2023 year-to-date performance in...

Latest Articles

What If Canada Became the 51st State?

Exploring the Impact on Canada's Property & Casualty Insurance Industry in a Hypothetical U.S. MergerWith recent headlines speculating about...

2024 Insurance Wrapped

2024 Wrapped: The Year That Shaped Canadian Insurance As the calendar turns to 2025, we reflect on a transformative year for the Canadian insurance...

Getting Started in Insurance: Education Paths for Students and Graduates

Insurance plays a vital role in supporting individuals, businesses, and communities worldwide. With diverse roles ranging from risk management to...

Claims + AI: The Good, The Bad, and The Ugly

Trigger Warning and Disclaimer The following article discusses sensitive topics, including a recent event involving violence. While the focus is on...

November 2024 MGA Roundup: A Glimpse Into 12 Canadian MGAs

As the year winds down, we’re taking a moment to spotlight 12 Canadian MGAs and their recent activities. From awards and recognitions to innovative...

8 Cyber Threat Categories: What You Need to Know

The Need for Cyber Insurance In today’s interconnected world, cyber threats pose a significant risk to businesses of all sizes. From small...

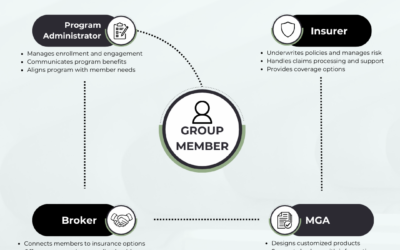

Affinity Programs Explained: A Guide to Group Insurance Solutions

In the insurance industry, affinity programs have become a powerful way for organizations to deliver added value to their members. These programs...