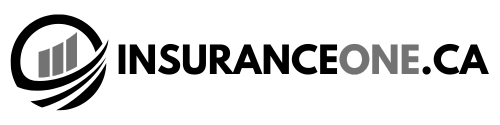

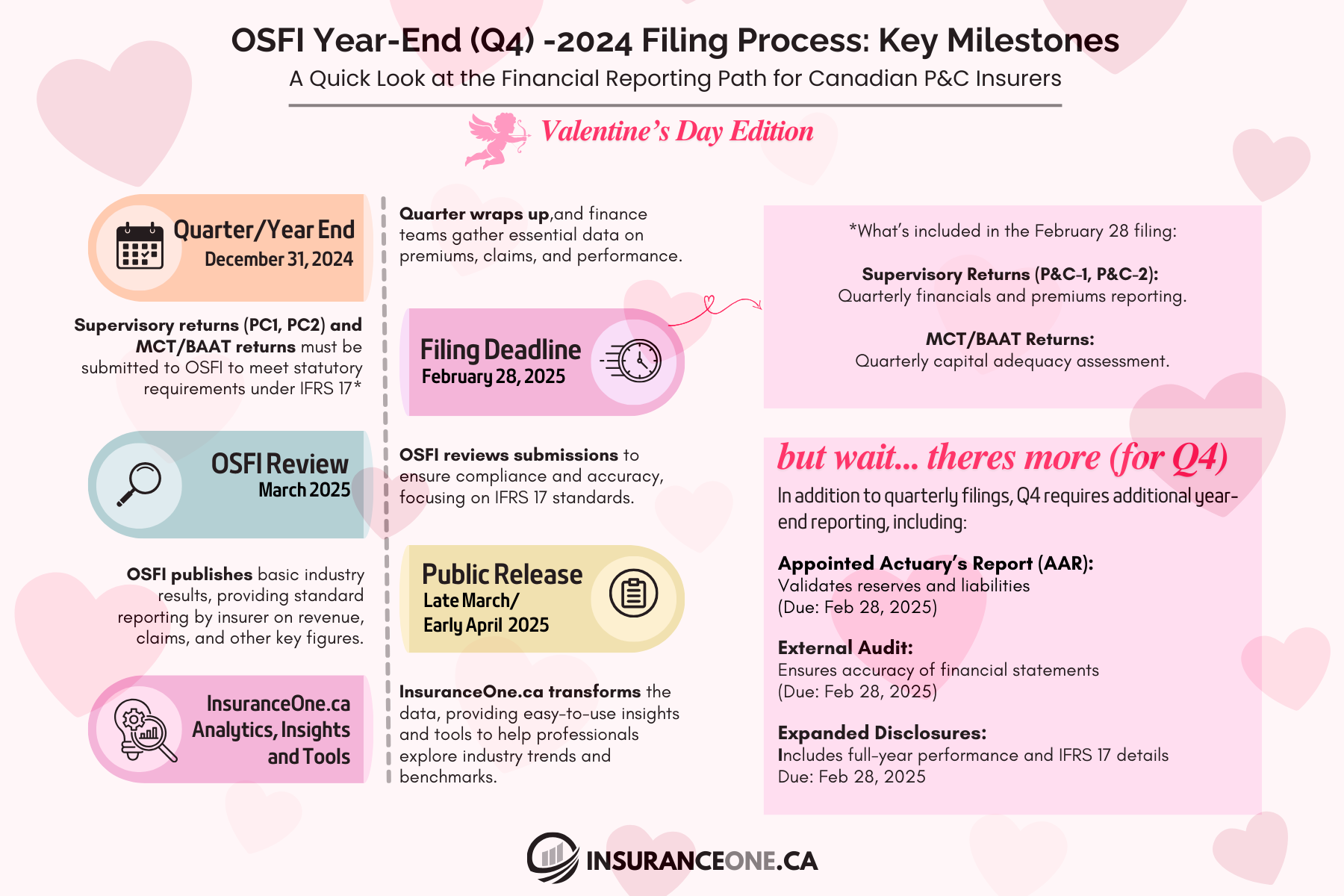

The year-end rush is over, and now it’s time for Canadian P&C insurers to focus on year-end OSFI filings. While every quarter has its challenges, Q4 comes with extra responsibilities, including the Appointed Actuary’s Report (AAR), external audits, and expanded disclosures under IFRS 17.

Show some love for your finance and actuarial teams who are hard at work ensuring compliance, accuracy, and transparency. Their dedication keeps everything running smoothly, even during the busiest time of the year!

🔍 What’s next?

📅 February 14, 2025: Filing deadline for P&C-1, P&C-2, and MCT/BAAT returns, plus year-end reporting requirements.

📅 March 2025: OSFI compiles and reviews submissions for consistency and accuracy under IFRS 17.

📅 Shortly After: InsuranceOne.ca will aggregate and share key results, trends, and insights to help you stay informed.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

Latest Data Insights from OSFI Reporting

Q4 2024 Canadian P&C Results and Insights

The Canadian Property & Casualty (P&C) insurance industry capped off 2024 with another quarter of robust financial performance. Based on...

Q3 2024 Canadian P&C Reinsurance Results

The Q3 2024 year-to-date (YTD) results for reinsurance companies, derived from OSFI-regulated financial data, provide a comprehensive look into the...

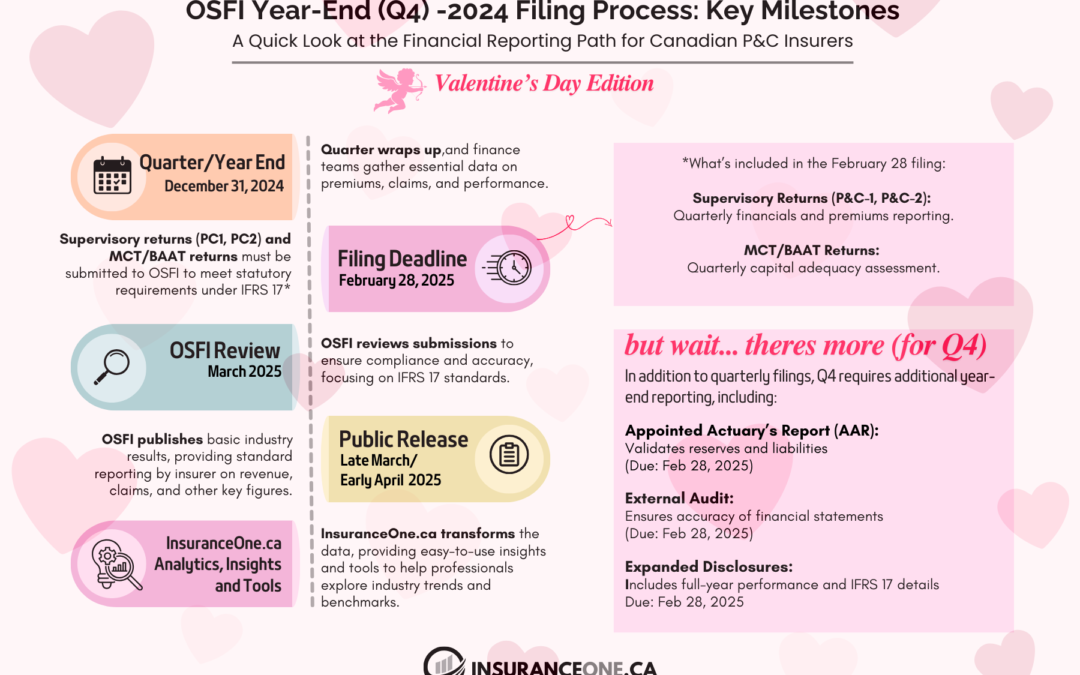

Q3 2024 Canadian P&C Results and Insights

The Q3 2024 year-to-date (YTD) results, based on OSFI-reported data, underscore the continued growth and resilience of Canada’s Property &...

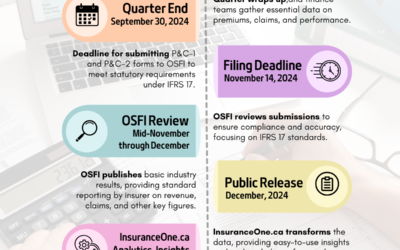

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and casualty (P&C) insurers, a critical milestone for...

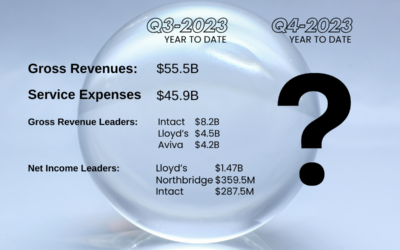

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on last year’s Q3-2023 year-to-date performance in...

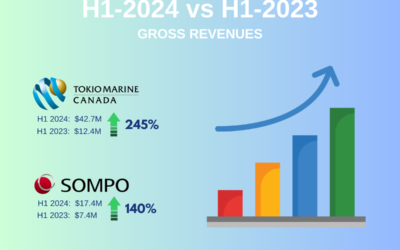

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property & Casualty (P&C) insurance sector. Leading the...

Latest Articles

What If Canada Became the 51st State?

Exploring the Impact on Canada's Property & Casualty Insurance Industry in a Hypothetical U.S. MergerWith recent headlines speculating about...

2024 Insurance Wrapped

2024 Wrapped: The Year That Shaped Canadian Insurance As the calendar turns to 2025, we reflect on a transformative year for the Canadian insurance...

GenAI for Insurance Professionals

Generative AI is reshaping industries at an unprecedented pace, and the insurance sector is no exception. By leveraging GenAI, professionals can...

Getting Started in Insurance: Education Paths for Students and Graduates

Insurance plays a vital role in supporting individuals, businesses, and communities worldwide. With diverse roles ranging from risk management to...

Claims + AI: The Good, The Bad, and The Ugly

Trigger Warning and Disclaimer The following article discusses sensitive topics, including a recent event involving violence. While the focus is on...

November 2024 MGA Roundup: A Glimpse Into 12 Canadian MGAs

As the year winds down, we’re taking a moment to spotlight 12 Canadian MGAs and their recent activities. From awards and recognitions to innovative...

8 Cyber Threat Categories: What You Need to Know

The Need for Cyber Insurance In today’s interconnected world, cyber threats pose a significant risk to businesses of all sizes. From small...

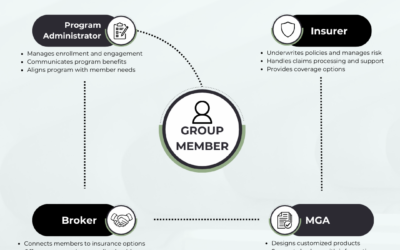

Affinity Programs Explained: A Guide to Group Insurance Solutions

In the insurance industry, affinity programs have become a powerful way for organizations to deliver added value to their members. These programs...