With recent headlines speculating about closer ties between Canada and the United States, the idea of Canada becoming the 51st U.S. state has been floating around in public discourse. What if it actually happened? While this remains a hypothetical scenario, it raises intriguing questions – especially for industries like property and casualty (P&C) insurance. How would the industry adapt if Canada’s insurance system were absorbed into the American framework? Let’s explore the potential impacts across several key areas.

This wouldn’t just be a bureaucratic shift – it would reshape industries, businesses, and the everyday lives of Canadians. Insurers would need to navigate new regulatory frameworks, adjust to cross-border competition, and rethink everything from claims processing to underwriting. Legal and cultural shifts would also come into play. Would Quebec’s language laws hold up in a predominantly English-speaking system? Would policy wording be adjusted to match U.S. spellings and legal definitions? And would Canadians embrace a U.S.-style insurance market, or push back against changes that could drive up costs and increase litigation?

1. Regulatory Landscape: Harmonization or Chaos?

If Canada were to become the 51st state, its regulatory framework would need to align with U.S. systems. Currently, Canada regulates insurance at both the provincial and federal levels, while the U.S. has a mix of state and federal oversight. The transition could be complex and create challenges for insurers.

- Federal vs. State Jurisdiction: Canada’s P&C insurance is regulated at both the provincial and federal levels, with the Office of the Superintendent of Financial Institutions (OSFI) overseeing federally regulated insurers. Transitioning to a U.S. system would mean reconciling the role of OSFI with the National Association of Insurance Commissioners (NAIC) framework, potentially phasing out OSFI’s oversight in favor of state-level regulators. This could create initial confusion for insurers accustomed to OSFI’s stringent solvency and compliance regulations.

- Admitted vs. Non-Admitted Markets: The U.S. insurance system differentiates between admitted carriers, which are licensed and regulated within a given state, and non-admitted insurers, which operate through surplus lines markets. In Canada, regulation is more centralized, with fewer distinctions. The shift to a U.S.-style admitted vs. non-admitted system could introduce complexities for insurers used to Canada’s licensing framework.

- Impact on Quebec: Quebec’s unique civil law system and publicly managed auto insurance plan would face significant adjustments to align with U.S. standards. Would it still include coverage for hockey-related parking lot disputes? Or would bilingual insurance policies become mandatory across all 51 states?

2. Legal and Language Adjustments

Beyond regulatory shifts, integrating Canada into the U.S. would bring legal and contractual changes, particularly in policy wording, compliance requirements, and language laws.

- Language and Wording Considerations: Insurance contracts would need to align with U.S. legal terminology, meaning Canadian insurers might find themselves replacing terms like “neighbour” with “neighbor” and adjusting legal definitions to match American frameworks. Liability limits, exclusions, and coverage interpretations could also be rewritten to reflect U.S. court precedents. But let’s be honest, no amount of legal harmonization will get Canadians to stop saying “sorry” before filing a claim.

- Quebec’s Language Protections: Quebec’s Charter of the French Language mandates that insurance policies be available in French, which could pose challenges in a predominantly English-speaking U.S. system. Would the state of Quebec negotiate federal protections, or would it be expected to conform? A bilingual insurance market in one U.S. state would be unprecedented, potentially setting off broader legal debates.

- Cross-Border Compliance: Canadian insurers accustomed to national regulations would have to adjust to a state-by-state compliance system. Filing policies, licensing agents, and handling claims across different U.S. jurisdictions could add complexity, especially for insurers operating in multiple provinces today under a single framework.

While the legal transition would bring standardization in some areas, it could also create new regulatory hurdles, language disputes, and administrative burdens for insurers adapting to U.S. laws.

Some Comparisons

|  |

|

|---|---|---|

| Regulation | Federally (OSFI) & provincially regulated | Regulated primarily at the state level |

| Auto Insurance | Some provinces have public auto insurance (e.g., ICBC, SGI) | Private insurers dominate in all states |

| Legal System | Common law (except Quebec: civil law) | Common law in all states |

| Claims Process | More policyholder-friendly, less litigation | More legal disputes, greater reliance on lawsuits |

| Premium Pricing | More regulated, risk-based in some provinces | More market-driven, influenced by litigation |

| Reinsurance Market | Mix of Canadian and international reinsurers | Dominated by global reinsurance firms |

| Currency & Pricing | Priced in CAD | Priced in USD |

| Broker Licensing | Licensed per province | Licensed per state |

| Surplus Lines Market | Less common, more regulated | Large, heavily utilized for unique risks |

| Language | English & French (Quebec mandates French policies) | Primarily English; Spanish is common in some states |

3. Cross-Border Competition: Friend or Foe?

The merger would erase international borders, opening the door for U.S. insurers to directly compete in the Canadian market and vice versa.

- Increased Competition: Some American giants may already have operations in Canada, and some have subsidiaries and a strong presence, such as Travelers, WRBC, and Chubb, while others have previously sold their Canadian operations to local insurers, such as State Farm’s sale to Desjardins. If Canada became a U.S. state, these companies could expand their footprint without international regulatory barriers. Canadian insurers might struggle to keep pace with their deep-pocketed U.S. counterparts. It might feel like a curling match where the Americans brought Zambonis.

- Opportunities for Growth: Conversely, Canadian insurers like Intact Financial and Aviva Canada could enter the larger U.S. market more freely, potentially unlocking growth opportunities.

4. Pricing Disparities: Will Premiums Skyrocket?

Insurance premiums vary widely between Canada and the U.S. due to differences in risk modeling, legal environments, and healthcare systems. These disparities could lead to noticeable shifts in pricing.

- Auto Insurance: American insurers typically operate in a more litigious environment, which often drives up premiums. Canadians might see higher rates as U.S.-style tort systems replace no-fault systems in some provinces. One thing’s for sure: Canadians will still apologize before filing a claim.

- Home Insurance: On the flip side, U.S. homeowners’ insurance rates could bring potential cost savings to Canadians in less disaster-prone areas. However, regions vulnerable to wildfires or floods might experience premium hikes.

5. Claims Handling: A Shift in Culture?

The U.S. and Canada differ significantly in how claims are processed, with Canadian insurers generally emphasizing a more client-focused, service-driven approach, while American insurers tend to operate in a more litigious, efficiency-driven framework. A unified market could bring notable changes to how claims are handled, resolved, and disputed.

- Litigation: Claims disputes in Canada could become far more litigious under U.S. legal norms, increasing costs for both insurers and policyholders. American-style settlements often involve legal battles, whereas Canadian claims culture tends to favor mediation and quicker resolutions. Policyholders may have to adjust to a system where lawsuits over coverage disputes are more frequent.

- Catastrophe Response: The integration could enhance disaster response capabilities, allowing insurers to pool resources across North America for hurricanes, wildfires, and other large-scale events. However, risk models may shift, and certain disasters like earthquakes in British Columbia or winter storm damage in Ontario might receive different prioritization under U.S. frameworks. One thing is certain: moose collisions would remain a uniquely Canadian concern.

- Fraud Prevention and Claims Verification: The U.S. insurance market has developed aggressive anti-fraud measures, including stricter claims investigations and data-sharing networks among insurers. Canadian insurers accustomed to a more trust-based system might face an adjustment period as fraud detection technologies and legal scrutiny increase.

- Claims Adjuster Operations: With differing regulatory frameworks, independent adjusters and third-party claims administrators might need to restructure their operations to align with U.S. state-based regulations. This could impact response times and policyholder experiences, especially in more rural or remote areas.

- Consumer Expectations: Canadian policyholders who are used to relatively straightforward claims settlements may experience longer disputes, more negotiations, and stricter policy interpretations under a U.S.-style system. This could lead to frustration among policyholders accustomed to a more service-oriented model.

While a unified system could bring more resources and efficiency in certain areas, it might also introduce higher costs, increased legal battles, and cultural adjustments for both insurers and policyholders.

6. Talent and Workforce: A Brain Drain or Brain Gain?

The insurance workforce in Canada and the U.S. is highly specialized, with professionals trained under different regulatory and market conditions. Merging these markets could create new opportunities but also significant disruptions.

- Talent Migration: Skilled Canadian professionals might seek higher-paying opportunities in U.S. hubs like New York and Chicago, leading to a brain drain from Canada. At the same time, U.S. insurers could tap into a new talent pool without cross-border hiring restrictions.

- Licensing and Certification: Canadian professionals would need to transition to U.S. licensing systems, which could create barriers for some. Adjusters, underwriters, and brokers might have to pass new exams or certifications to continue working.

- Risk of Leaving North America Altogether: With increased mobility, some professionals might look beyond the U.S. and Canada for career growth, considering global insurance hubs like London, Bermuda, or Zurich.

- Impact on Education and Training: Universities and insurance institutes in Canada would need to align with U.S. standards, ensuring that new graduates meet American licensing and regulatory requirements.

While the expanded job market could provide more options for professionals, it might also create challenges for smaller Canadian firms struggling to retain talent in a more competitive environment.

7. Economic Impact: Winners and Losers

The economic implications of unification would ripple through the insurance industry, reshaping its structure, competitiveness, and investment priorities. While some firms might thrive in an expanded market, others could struggle to adapt to new regulations and increased competition.

- M&A Activity: Cross-border mergers and acquisitions could surge, as insurers position themselves to capitalize on the newly integrated market. Larger U.S. insurers might acquire Canadian firms to expand their footprint, while some Canadian companies could struggle to remain independent in a more competitive landscape.

- Investment in Technology: A unified market could spur investment in AI, predictive analytics, and automation, as insurers work to standardize underwriting and claims processes across a larger, more diverse customer base. Companies that adapt quickly to digital transformation could gain a significant advantage.

- Shifts in Capital and Reserves: Canadian insurers, many of which operate under stricter solvency requirements set by OSFI, might have to adjust to U.S. capital reserve standards, potentially freeing up capital for investment but also exposing them to more financial volatility.

- Job Market Impacts: Economic shifts could create opportunities in some sectors and losses in others. Larger firms may expand, while smaller regional insurers could face consolidation or closures. Additionally, as insurers align operations across North America, some back-office and administrative roles could be outsourced or automated.

- Impact on Brokers and Agents: Insurance distribution channels could also see disruption. Independent Canadian brokers accustomed to provincial regulatory structures might need to restructure their licensing and operations to comply with U.S. state-level regulations.

While some insurers and professionals would benefit from a larger, more integrated market, others might struggle with new competitive pressures and regulatory realignment.

8. Currency Impacts: Dollars and “Sense”

One of the most immediate and visible changes would be the shift from the Canadian dollar to the U.S. dollar, bringing both simplifications and challenges to the insurance industry.

- Premiums and Claims: Insurance policies currently priced in Canadian dollars would need to be recalibrated, potentially leading to pricing fluctuations as insurers adjust for U.S. economic conditions and regional cost differences.

- Reinsurance Agreements: Many reinsurance contracts already use U.S. dollars as a baseline, so the transition could simplify agreements for Canadian insurers. However, legacy contracts and financial models may need restructuring to align with the new currency system.

- Economic Sensitivity: Tying insurance pricing to the U.S. economy could expose Canadian policyholders to U.S. inflation, interest rate shifts, and market volatility, affecting premium stability and affordability.

- Cross-Border Trade: While adopting the U.S. dollar would eliminate foreign exchange risk for insurers doing cross-border business, it might also increase operational costs for insurers used to Canadian financial regulations and banking systems.

The shift to a single currency could streamline transactions, but it might also create short-term disruptions in pricing, reserves, and financial planning for insurers and policyholders alike.

9. Beyond the Insurance Companies

The insurance industry doesn’t operate in isolation—it relies on a vast network of government agencies, legal experts, and service providers. If Canada joined the U.S., these support systems would face significant adjustments.

- Government Roles: Provincial regulators and administrators responsible for insurance oversight would likely see their roles reshaped or absorbed into state-level departments. OSFI’s influence would diminish, and each former province would need to align with individual U.S. state regulations.

- Legal Sector: Canadian law firms specializing in insurance law would need to adapt to U.S. legal frameworks, particularly in areas like claims litigation and contract interpretation. Quebec’s unique legal system, based on civil law, could face even greater challenges integrating with common law jurisdictions.

- Vendors and Service Providers: Companies that support the insurance industry—such as claims adjusters, underwriting software providers, and third-party administrators—would need to scale operations and navigate state-by-state regulatory differences to remain competitive in the new market.

- Education and Certification Bodies: Organizations that certify brokers, adjusters, and risk managers would need to modify their programs to match U.S. licensing standards, potentially creating a transition period of retraining and recertification.

While some organizations may benefit from expanded business opportunities, others may struggle to adjust to new regulations and competition from larger U.S. firms.

Want to Access More In-Depth Company Data?

Subscribe to gain free access to exclusive data, valuable insights, and upcoming powerful tools!

Explore detailed company data and trends

Receive exclusive industry insights

Get access to upcoming powerful tools

Latest Articles

2024 Insurance Wrapped

2024 Wrapped: The Year That Shaped Canadian Insurance As the calendar turns to 2025, we reflect on a transformative year for the Canadian insurance...

GenAI for Insurance Professionals

Generative AI is reshaping industries at an unprecedented pace, and the insurance sector is no exception. By leveraging GenAI, professionals can...

Getting Started in Insurance: Education Paths for Students and Graduates

Insurance plays a vital role in supporting individuals, businesses, and communities worldwide. With diverse roles ranging from risk management to...

Claims + AI: The Good, The Bad, and The Ugly

Trigger Warning and Disclaimer The following article discusses sensitive topics, including a recent event involving violence. While the focus is on...

November 2024 MGA Roundup: A Glimpse Into 12 Canadian MGAs

As the year winds down, we’re taking a moment to spotlight 12 Canadian MGAs and their recent activities. From awards and recognitions to innovative...

8 Cyber Threat Categories: What You Need to Know

The Need for Cyber Insurance In today’s interconnected world, cyber threats pose a significant risk to businesses of all sizes. From small...

Latest OSFI Insights

Q4 2024 Canadian P&C Results and Insights

The Canadian Property & Casualty (P&C) insurance industry capped off 2024 with another quarter of robust financial performance. Based on...

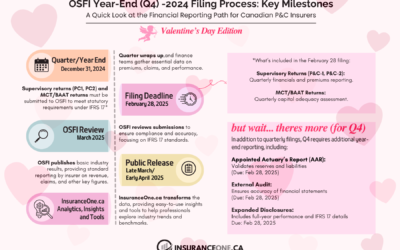

OSFI Filing Day Alert: February 28 is Around the Corner!

The year-end rush is over, and now it’s time for Canadian P&C insurers to focus on year-end OSFI filings. While every quarter has its...

Q3 2024 Canadian P&C Reinsurance Results

The Q3 2024 year-to-date (YTD) results for reinsurance companies, derived from OSFI-regulated financial data, provide a comprehensive look into the...

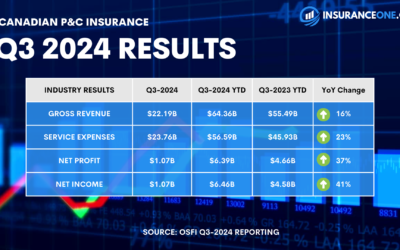

Q3 2024 Canadian P&C Results and Insights

The Q3 2024 year-to-date (YTD) results, based on OSFI-reported data, underscore the continued growth and resilience of Canada’s Property &...

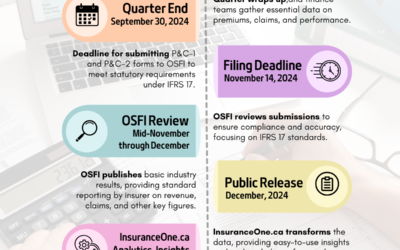

Navigating the OSFI Q3-2024 Filing Process

Today, November 14, marks the official OSFI Q3-2024 filing deadline for Canadian property and casualty (P&C) insurers, a critical milestone for...

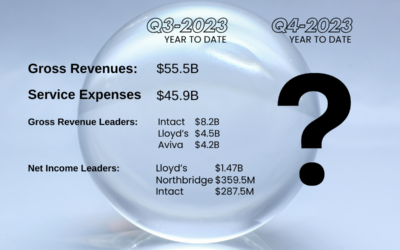

What Are Your Predictions for Canada’s Q3-2024 P&C Insurance Results?

With Q3-2024 results from OSFI-regulated insurers on the horizon, it’s a great time to reflect on last year’s Q3-2023 year-to-date performance in...

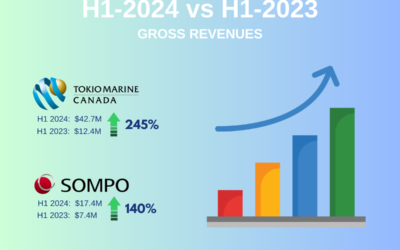

Canada’s Top 10 P&C Insurers: First Half 2024 Year Over-Year Growth Leaders

The Q2-2024 results highlight the resilience and growth potential within Canada’s Property & Casualty (P&C) insurance sector. Leading the...

Q2 2024 Canadian P&C Results and Insights

The Q2 2024 results, based on OSFI-reported data, reflect steady financial performance across Canada’s Property & Casualty (P&C) insurance...

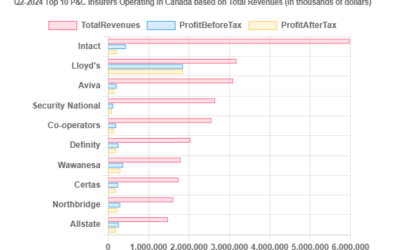

Canada’s Top 10 P&C Insurers: Q2 2024 Profit Leaders

The Q2-2024 results underscore the financial strength of Canada’s Property & Casualty (P&C) insurance sector, with total net profits after...

Canada’s Top 10 P&C Insurers: Q2 2024 Revenue Leaders

As of Q2 2024, Canada’s Property and Casualty (P&C) insurance industry achieved substantial revenue growth, reaching a year-to-date total of...

Fun & Games

Friday FunDay Game for February 14, 2025

💘 Friday Funday: Love & Risk – The Insurance Edition! 💘 This week, we’re celebrating Valentine’s Day with a fun, insurance-themed quiz! Love and...

Friday FunDay Game for January 24, 2025

Welcome to this week’s Friday Funday! We're switching things up this week with "Playing with Matches" – a fun insurance-themed matching game! Test...

Crossword Puzzle for January 17, 2025

Welcome to this week’s Friday Funday! Dive into our latest insurance-themed crossword puzzle, featuring cyber insurance terms and concepts. Test...

Crossword Puzzle for January 10, 2025

Get ready for this week’s Friday Funday with a new insurance-themed crossword puzzle. This one highlights some of Canada’s MGAs. Test your...

Crossword Puzzle for January 3, 2025

Kick off the new year with our first Friday Funday insurance-themed crossword puzzle! Start the year with a simple challenge to test your knowledge...